Why should you E-File Form 8038-CP with ExpressTaxExempt?

IRS Authorized Provider

Direct Form Entry Filing Method

Attach your 8038-CP Schedule A for FREE

Additional Users to Manage Accounts

No subscription fees or contracts

Live Chat, Email, & Phone Support

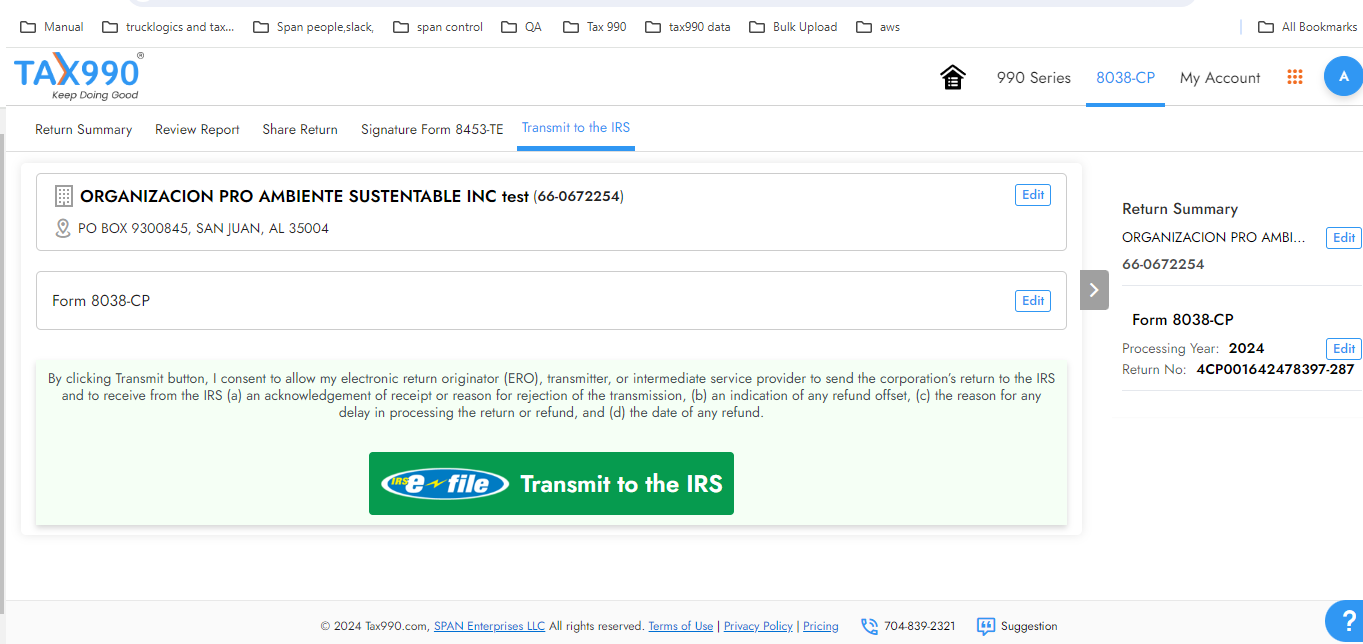

How to File Form 8038-CP Electronically?

E-File IRS Form 8038-CP in 3 simple steps.

Ready to E-file Form 8038-CP?

Frequently asked questions

Qualified tax-exempt organizations and government entities that have received approval from federal government entities to issue the following bonds use this form to claim credit payments.

- Build America Bonds (BABs),

- Recovery Zone Economic Development Bonds (RZEDBs),

- New Clean Renewable Energy Bonds (NCREBs),

- Qualified Energy Conservation Bonds (QECBs),

- Qualified Zone Academy Bonds (QZABs) and

- Qualified School Construction Bonds (QSCBs)

A Form 8038-CP must be filed no later than 45 days before the relevant interest payment date. 8038-CP Form may not, however, be submitted earlier than 90 days before the relevant interest payment date.

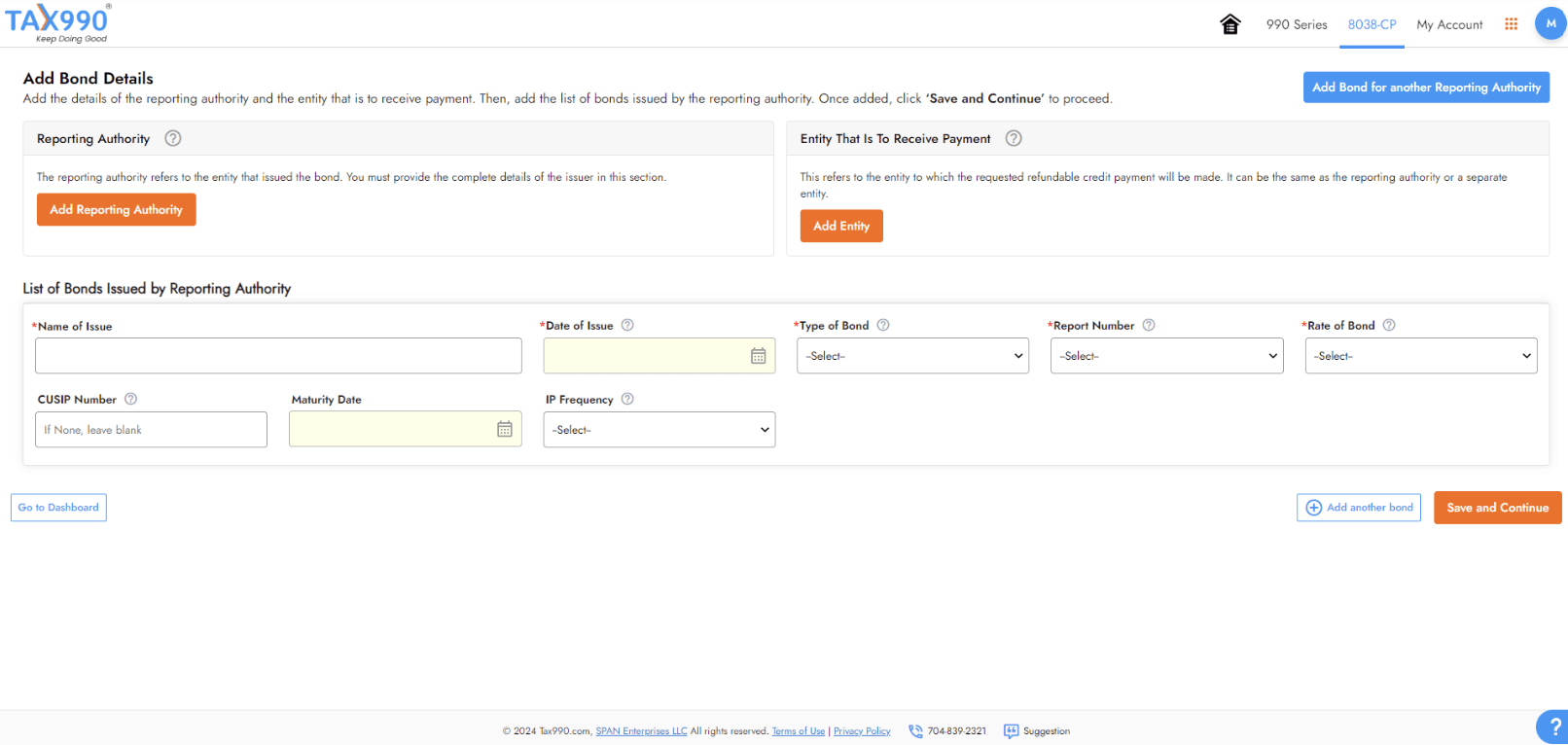

Here is the list of major information that you’ll need to file Form 8038-CP online,

- Details of the reporting entity (issuer)

- Details of the entity that is to receive the payment

- Information regarding the bond issue

- Interest payment date

- Amount of credit payment requested

Schedule A must be attached with IRS Form 8038-CP for the following bonds:

- New Clean Renewable Energy Bonds (NCREBs),

- Qualified Energy Conservation Bonds (QECBs),

- Qualified Zone Academy Bonds (QZABs) and

- Qualified School Construction Bonds (QSCBs)

Visit https://www.expresstaxexempt.com/form-8038-cp/form-8038-cp-filing-instructions/ to know more about Form 8038-CP filing instructions.

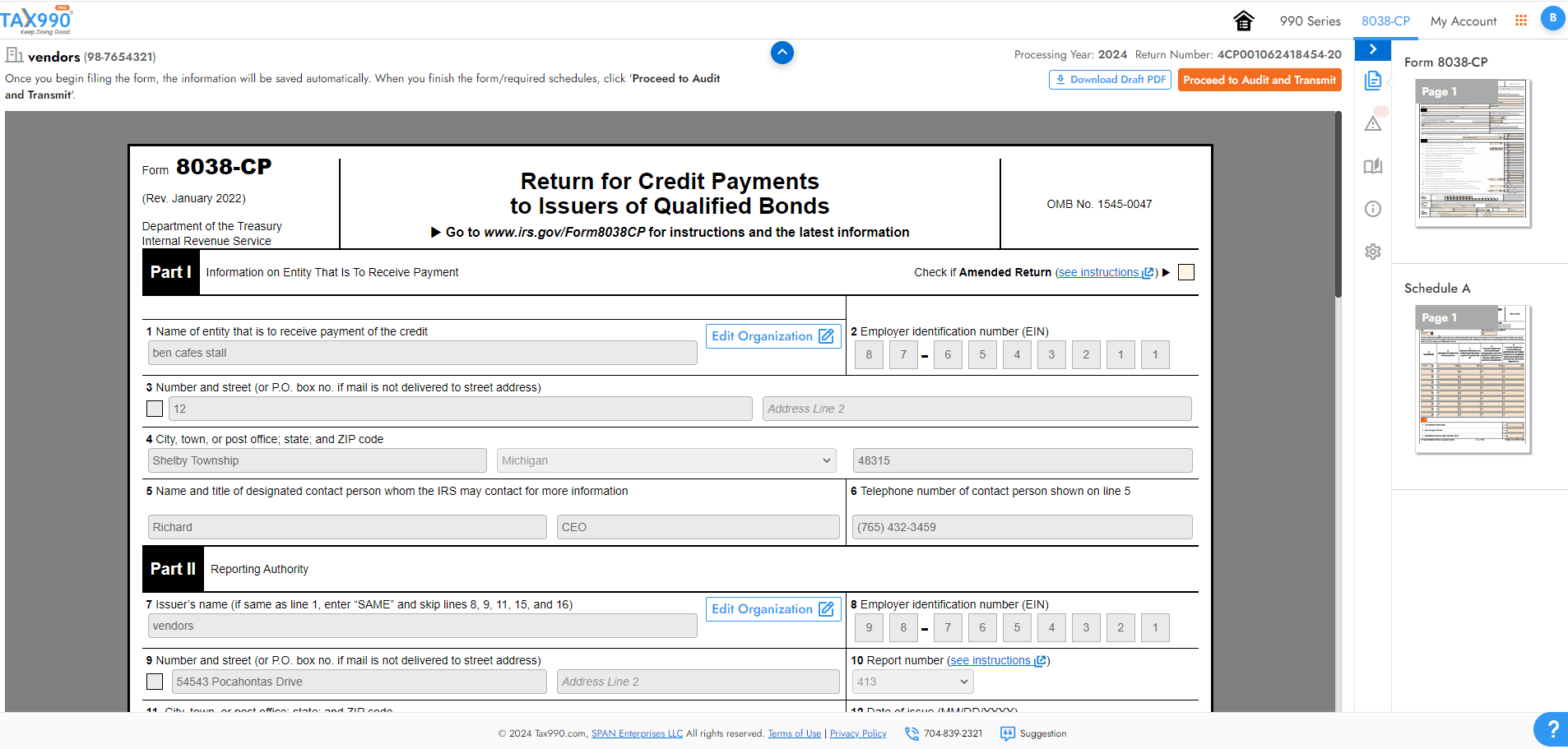

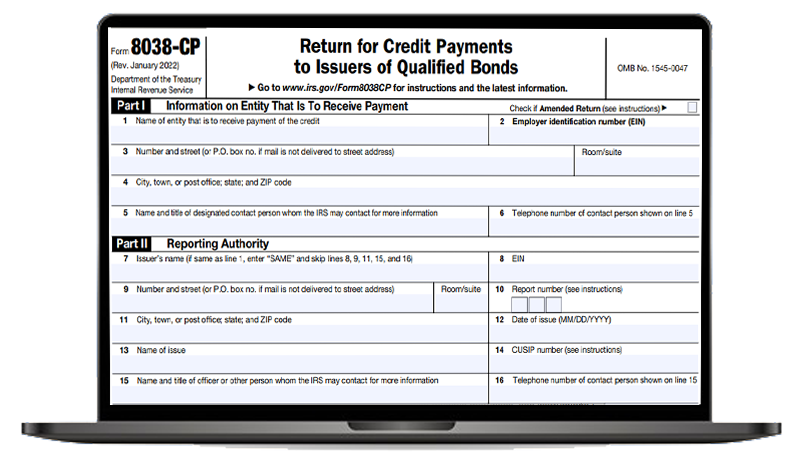

Here’s the breakdown of Form 8038-CP:

- Part I : Information on Entity That Is To Receive Payment

- Part II: Reporting Authority

- Part III: Payment of Credit

Check out our line-by-line instructions to understand how to fill out Form 8038-CP.

The IRS mandates e-filing of Form 8038-CP if the filer is required to submit 10 or more forms in a calendar year. If you are eligible to paper file, complete the form and mail it to the address below.

Department of the Treasury,

Internal Revenue Service Center,

Ogden, UT 84201-0050.

.png)

.png)

.png)